41 coupon vs interest rate

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) Coupon rates are more likely influenced by the interest rates fixed by the government body on the basis country's economy. While calculating the current yield, the coupon rate compares to the current market price of the bond.

What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Coupon vs interest rate

Difference Between Coupon Rate and Required Return The rate of interest paid by the person who issues the bond based on the bond's face value is called the coupon rate. The periodic interest paid by the person who issues the bond to the buyer is called the coupon rate. › discount-rate-vs-interest-rateDiscount Rate vs Interest Rate | 7 Best Difference (with ... The interest rate will be higher if the borrower’s profile is considered risky, the rate of interest charged on them will be on the higher side. Head to Head Comparison Between Discount Rate vs Interest Rate (Infographics) Below is the top 7 difference between Discount Rate vs Interest Rate: › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) The coupon rate remains fixed for the entire duration of a bond as the coupon payment is fixed, and also the face value is fixed. Yield changes with the change in the market price of a bond. Effect of interest rate: Change in the interest rate in the economy by the central bank has no effect on the coupon rate of a bond.

Coupon vs interest rate. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The coupon Rate is not generally linked to any other debt instrument. Interest Rate is ... APR Vs. Interest Rate: What's The Difference? - Forbes Advisor Interest Rate vs. APR. Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR. Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR. CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in mid ... APR Vs. Interest Rate: What's The Difference? | Bankrate APR stands for annual percentage rate, and it represents the cost of your mortgage by including the interest rate and some other fees and closing costs. APR is not the same as your interest rate ...

APY vs Interest Rate: What Is the Difference [Guide for 2022] - Review42 APY: the actual rate of return you'll earn with compounded interest. Interest rate: the fixed rate of return you receive on savings accounts. APY vs interest rate: both earn you money on interest-based accounts. Interest rates are more common and offer lower returns than an APY. The higher the APY, the better. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. economictimes.indiatimes.com › definition › coupon-rateWhat is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market. Interest Vs. Dividends: Definition, Pros & Cons - Business Insider Investing $1,000 in a one-year CD at a rate of 3% would yield $30 in simple interest over the term, plus your initial $1,000 investment. Not the greatest return, but it's guaranteed.

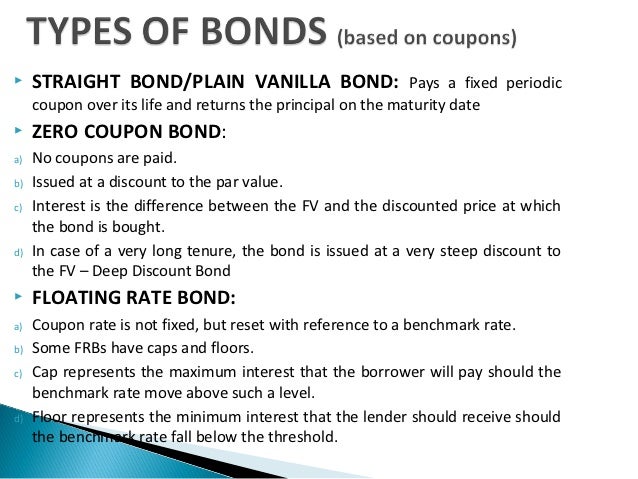

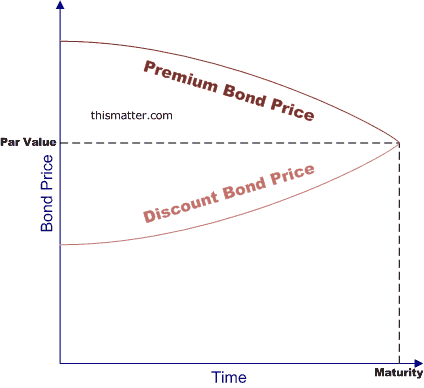

How are bond yields different from coupon rate? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case the total annual interest payment equals Rs 20 x 2 = Rs 40. The annual coupon rate for... What's the Difference Between Premium Bonds and Discount Bonds? A premium bond has a coupon rate higher than the prevailing interest rate for that bond maturity and credit quality. A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let's say you own an older bond—one that was ... Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay ...

Coupon Rate vs Interest Rate - WallStreetMojo A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is ...

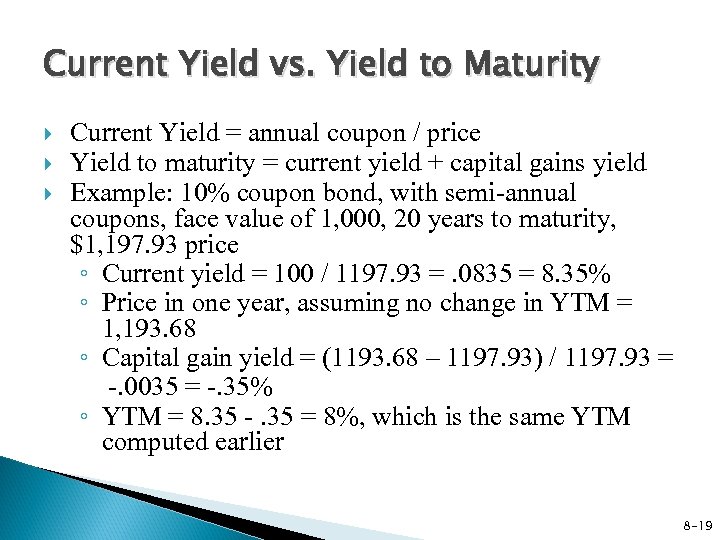

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

APR vs. Interest Rate: How are They Different? - MoneyWise The fees turn the interest rate into an APR of 3.37%. Loan B, which has an interest rate of 3%, 1 discount point costing $2,000, and $3,000 in other lender fees. The point and other fees turn the interest rate into an APR of 3.20%. Interest rates between the two loans differ by a quarter point (0.25).

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... It is important to distinguish coupon rate vs interest rate. Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other...

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "41 coupon vs interest rate"