41 duration zero coupon bond

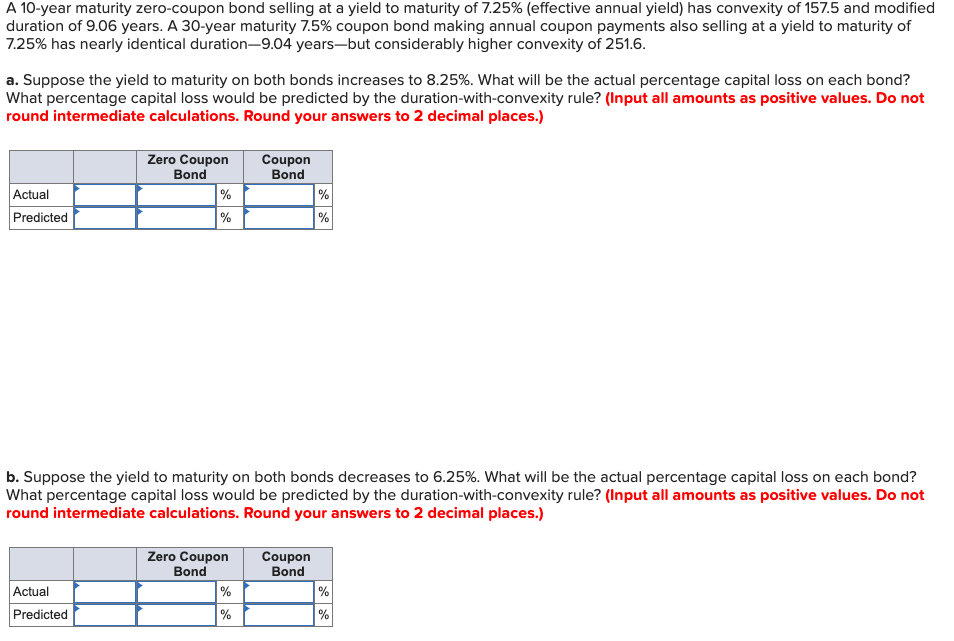

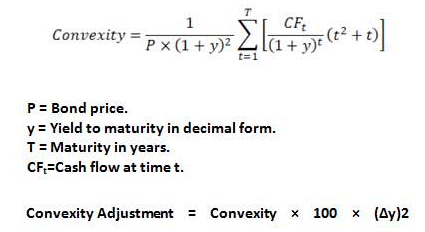

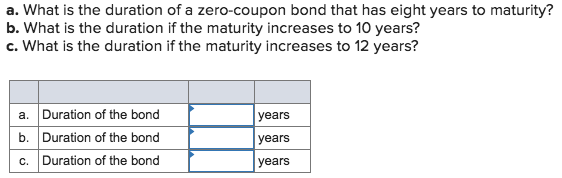

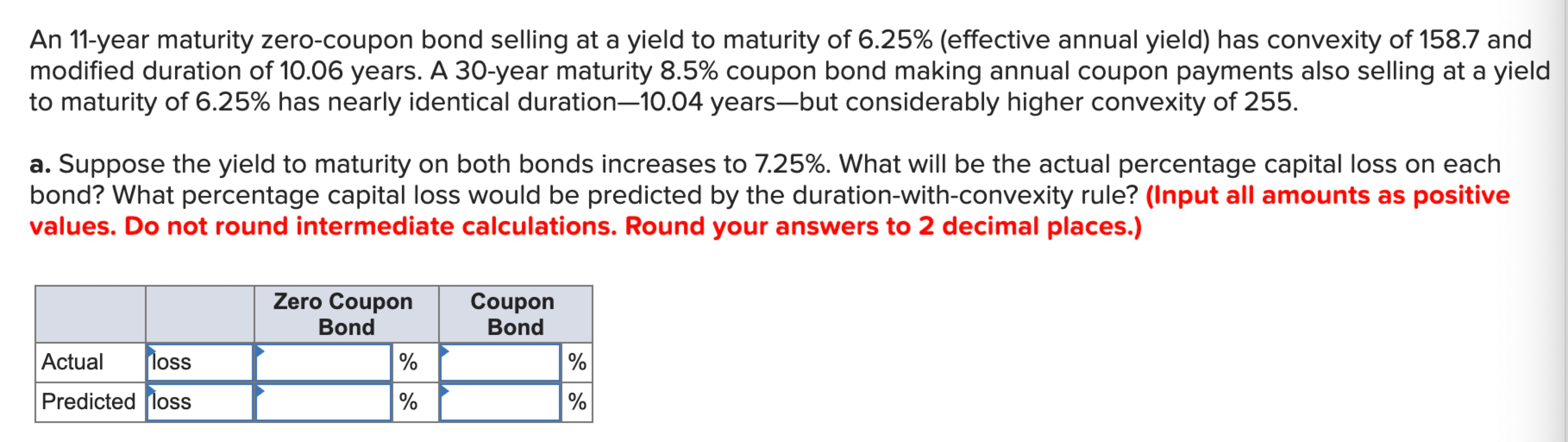

Solved 37. What is the duration of a zero-coupon bond that | Chegg.com 100% (1 rating) Zero coupon bond are not eligible for duration calculation as …. View the full answer. Transcribed image text: 37. What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years? › terms › dWhat Is Duration in Finance? - Investopedia Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

fixed income - Duration of callable zero coupon bond - Quantitative ... What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal to its maturity. But I am not getting convinced with my answer because of the callable feature in the question.

Duration zero coupon bond

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

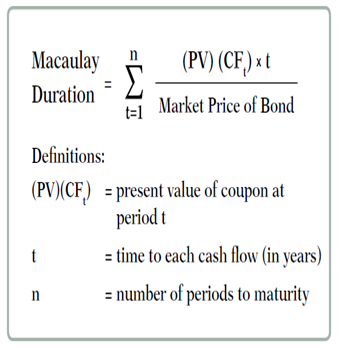

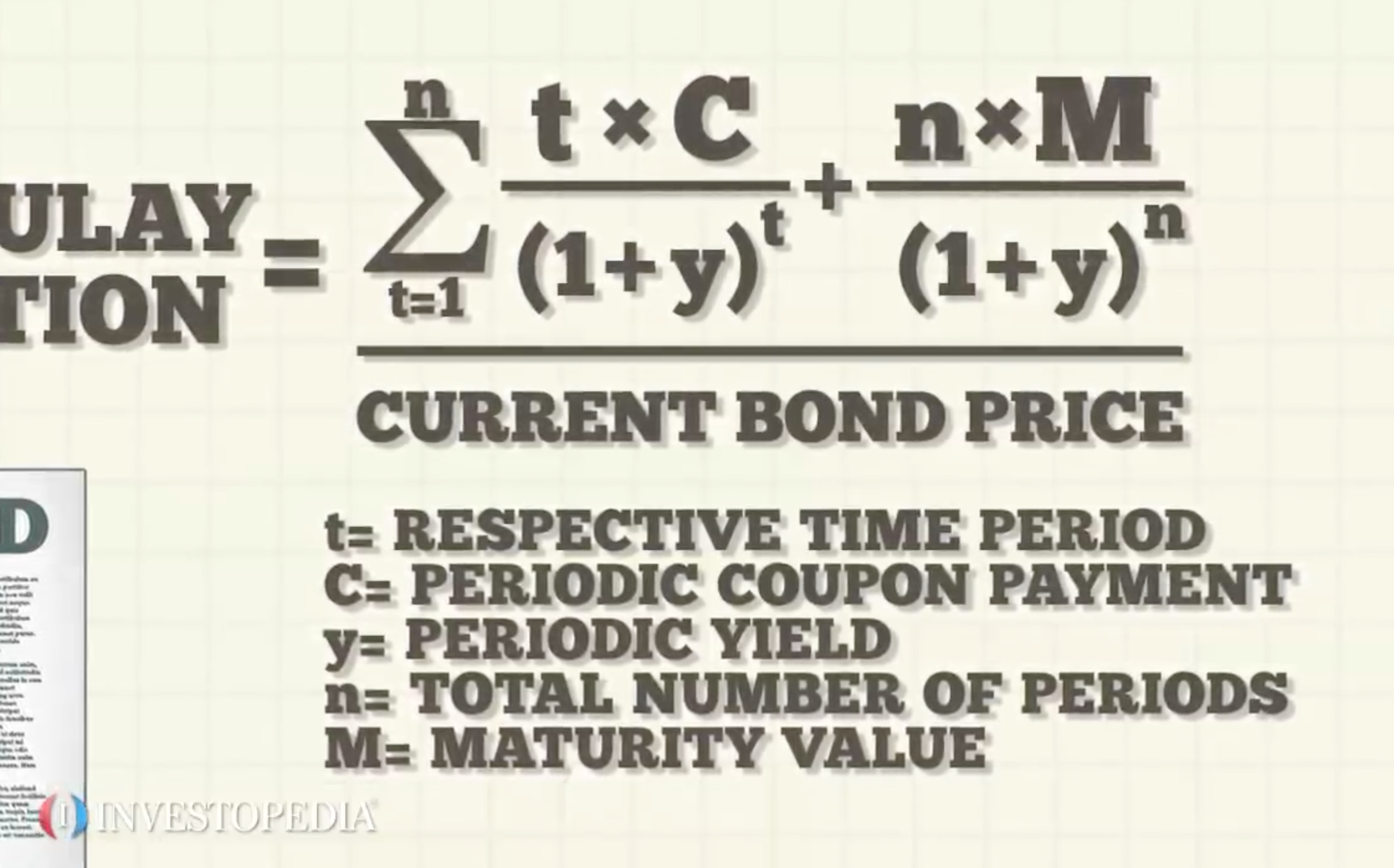

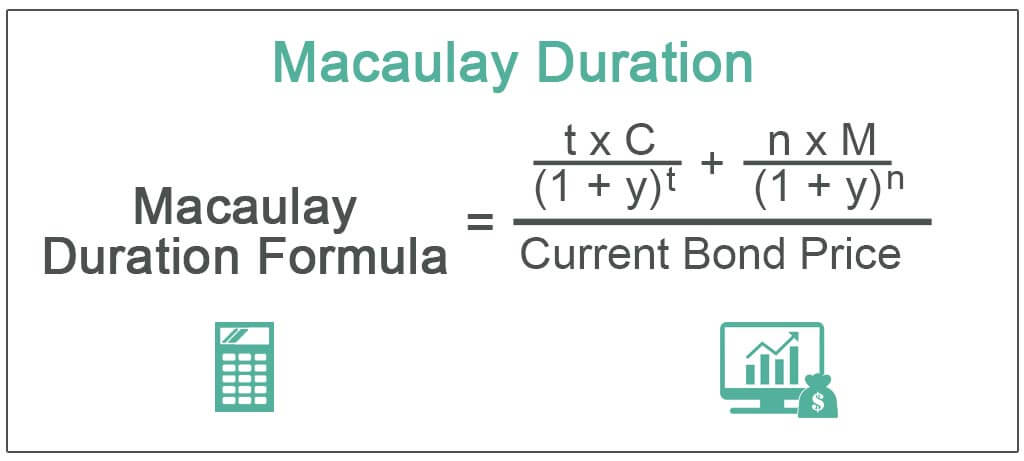

Duration zero coupon bond. The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and... What is the duration of a zero coupon bond? - Quora The duration of a zero coupon bond is equal to its maturity. Duration is a weighted average of the maturities of all the income streams of a bond or a portfolio of bonds. Therefore if there are coupons, the duration will be less than the maturity, and if there are no coupons it will be equal to its maturity. Pete Zeman duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012 #3 S Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, ... A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms ...

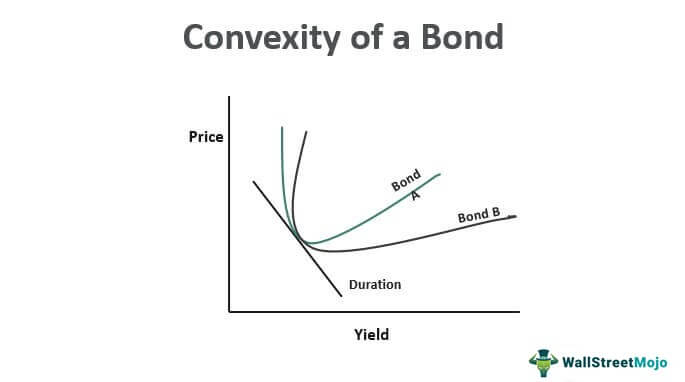

risk management - Calculate duration of zero coupon bond - Quantitative ... Let Pz (t, T ) be the price of a zero coupon bond at time t with maturity T and continuously compounded interest rate r. Duration = − 1 P d P d r Let A and a be two constants and x be a variable. Let F ( x) = A × e a x be a function of x. Then, the first derivative of F with respect to x, denoted by d F d x, is given by How to Calculate Bond Duration - wikiHow 3. Clarify coupon payment details. To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder). › convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N... What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used: › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. ... Ext Duration Treasury ETF." PIMCO. "PIMCO ... Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

Zero-Coupon Bond: Formula and Calculator [Excel Template] If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

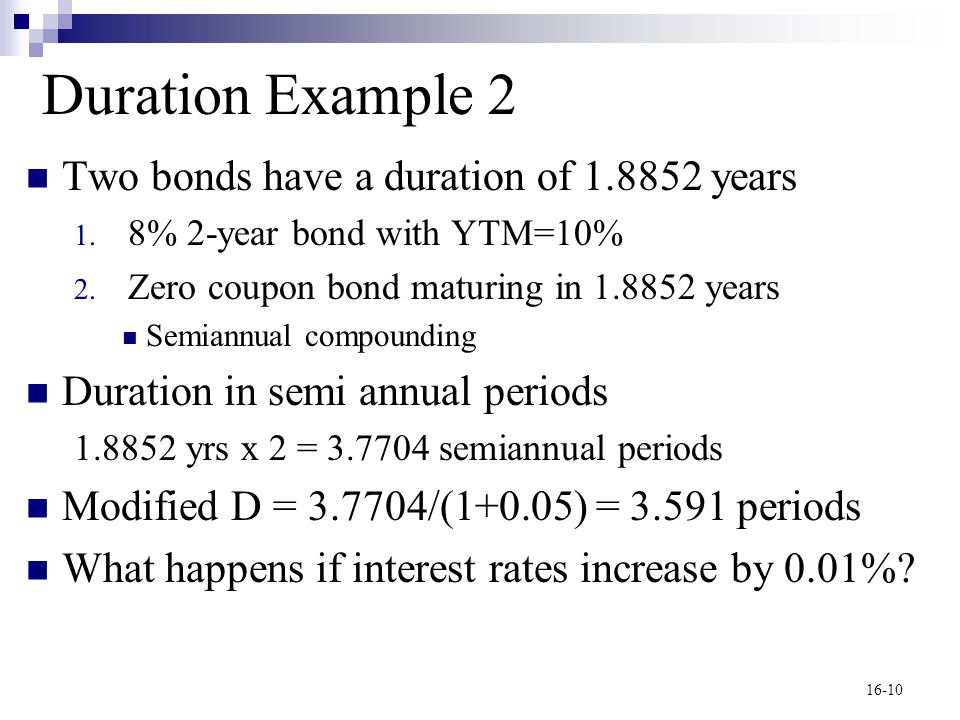

dqydj.com › bond-duration-calculatorBond Duration Calculator – Macaulay and Modified Duration From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%.

Dollar Duration - Overview, Bond Risks, and Formulas Dollar duration can be applied to any fixed income products, including forwarding contracts, zero-coupon bonds, etc. Therefore, it can also be used to calculate the risk associated with such products. Summary Dollar duration is the measure of the change in the price of a bond for every 100 bps (basis points) of change in interest rates.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

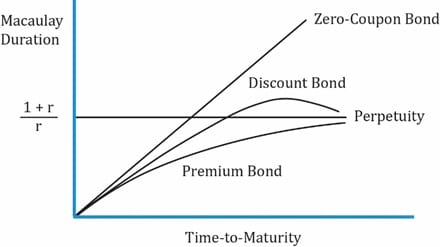

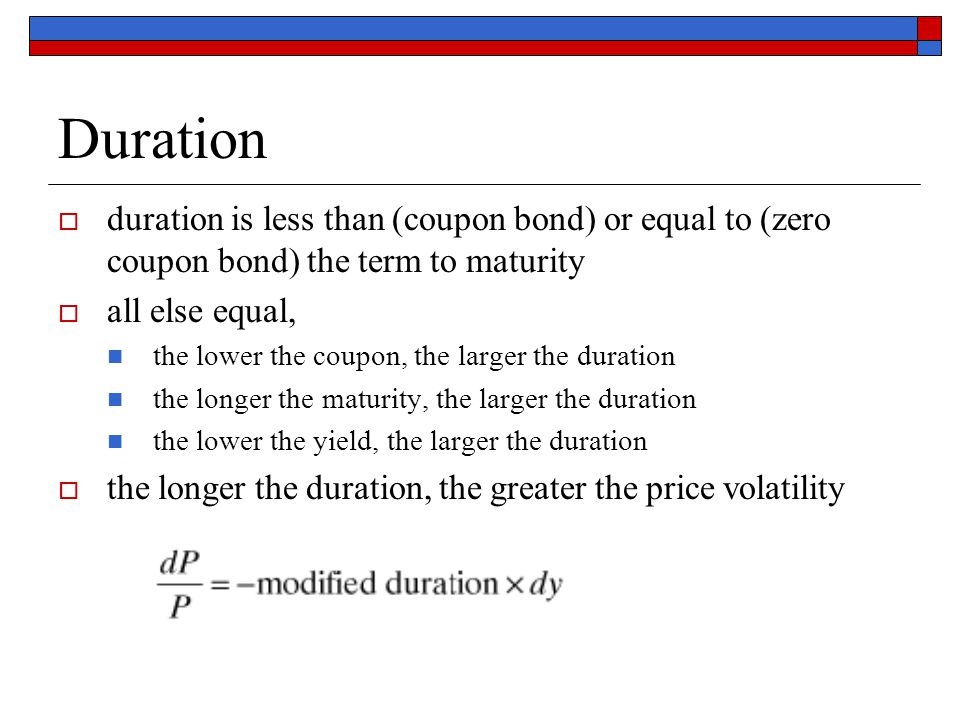

2022 CFA Level I Exam: CFA Study Preparation The Macaulay duration of a zero-coupon bond is its time-to-maturity. The Macaulay duration of a perpetual bond (perpetuity) is (1 + r) / r. Coupon rate is inversely related to Macaulay duration and modified duration. Yield-to-maturity is also inversely related to Macaulay duration and modified duration.

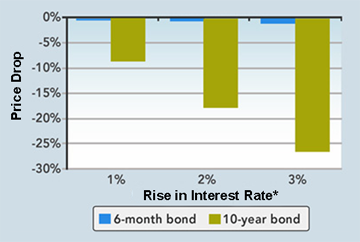

Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. Generally, bonds with long maturities and low coupons have ...

The duration of a zero coupon bond a is smaller than A Suppose the yield of five-year bond with 8% coupon is 10%. Its duration is: The higher a bond's coupon, the shorter its duration, because proportionately more payment is received before final maturity A. less than 5 years B. 5 years C. from 5 to 10 years D. more than 10 years

efinancemanagement.com › duration-of-a-bondDuration of a Bond | Portfolio Duration | Macaulay & Modified ... Jun 11, 2022 · The unit of bond duration is expressed in years. Also, the price of the bond and the interest rates are inversely related. Therefore, if a bond has a duration of 5 years, it signifies that for every 1% increase in the interest rate, the price of the bond will fall by 5% and vice-a-versa.

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/KeyRateDuration-5c6bb05bc9e77c00014764e8.jpg)

Post a Comment for "41 duration zero coupon bond"